AATS, 8 The Old Fire Station, Dun Laoghaire, Co. Dublin

P: 01 2845622 F:01 2301044

P: 01 2845622 F:01 2301044

Is your payroll operating properly?

Are you filing payroll returns on time?

Are you complying fully with all PAYE and PRSI regulations?

Are you familiar with benefit in kind rules and reporting obligations?

Are you familiar with employment legislation?

Failure to file accurate and timely returns can lead to significant interest and penalty costs. With effect from 1st January 2004, there are significant additional compliance obligations on employers with regards to the operation of Benefit in Kind rules on employees. Your business can outsource the complete payroll and compliance function to Accounting & Tax Services.

The outsourcing service includes:

Are you filing payroll returns on time?

Are you complying fully with all PAYE and PRSI regulations?

Are you familiar with benefit in kind rules and reporting obligations?

Are you familiar with employment legislation?

Failure to file accurate and timely returns can lead to significant interest and penalty costs. With effect from 1st January 2004, there are significant additional compliance obligations on employers with regards to the operation of Benefit in Kind rules on employees. Your business can outsource the complete payroll and compliance function to Accounting & Tax Services.

The outsourcing service includes:

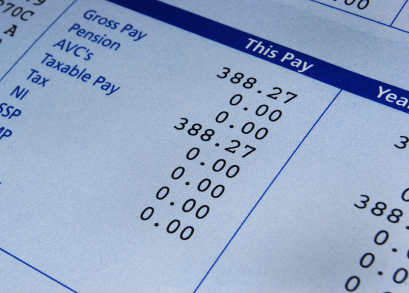

| O | Gross Pay Computations |

| O | Payroll reports |

| O | Issuing payslips |

| O | Electronic payments to staff |

| O | Completion and filing of monthly PAYE returns and the annual P35 return |

| O | Compliance with new benefits in kind compliance rules |

| O | Analysis of payroll costs by department |

| O | Staff deductions and discharge (health insurance, trade union subs etc) |

PAYROLL